AI Adoption and AI-Optimized Infrastructure Upgrades Reshape IT Spending Priorities in MENA

By : Bakinam Khaled

IT spending in the Middle East and North Africa (MENA) is projected to total $169 billion in 2026, an increase of 8.9% from 2025, according to the latest forecast by Gartner, Inc.

“The MENA region is rapidly emerging as a global tech powerhouse, with the Gulf Cooperation Council (GCC) leveraging its stability, infrastructure and forward-looking policies to attract global partners and build digital skills that empower innovation and support resilient AI-driven economies,” said Mim Burt, Practice VP at Gartner. “Even amid global economic and geopolitical uncertainty, chief information officers (CIOs) in MENA are making strategic investments in AI, intelligent automation and multi-cloud strategies, while strengthening cyber defenses and advancing talent upskilling.

These efforts are not only driving innovation and economic diversification but also contributing to the region’s projected IT spending growth in 2026.”

Data Center Systems Remain Highest-Growth Segment in 2026 Despite Slower Momentum

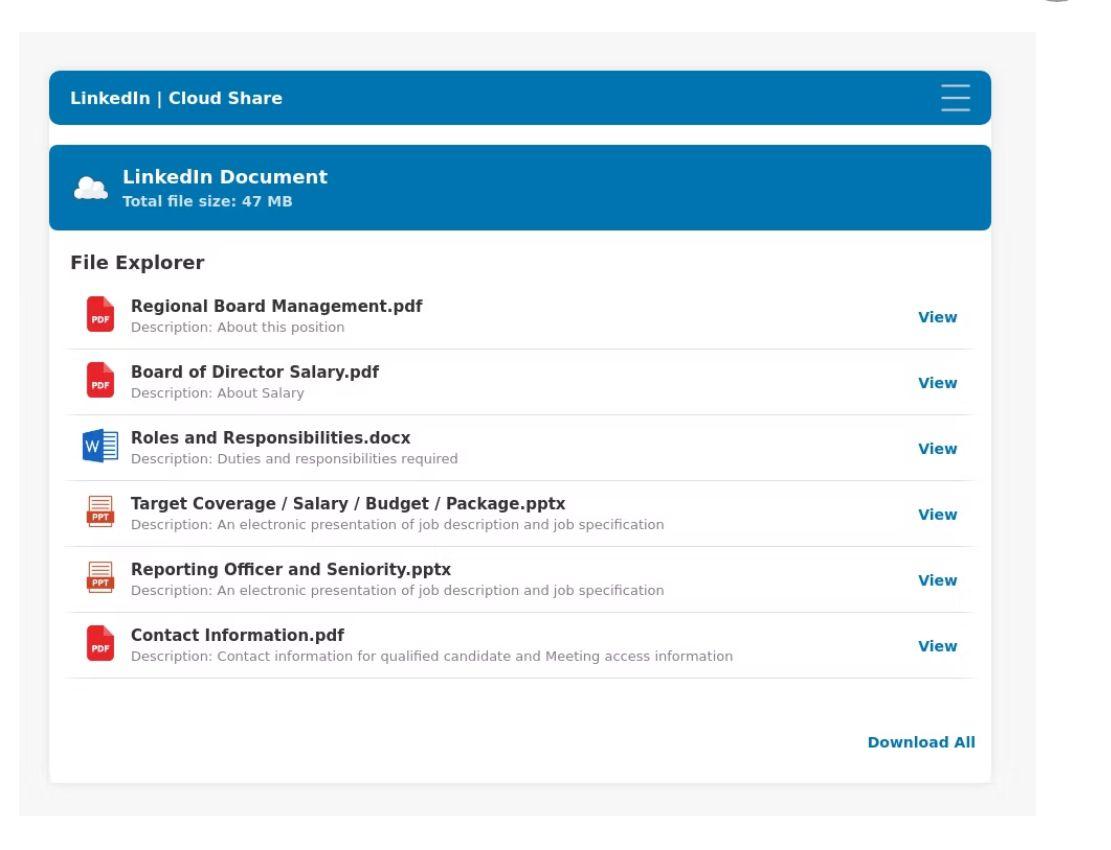

Growth in data center systems spending in MENA is expected to remain strong in 2026, though the pace will ease compared to 2025. Spending is projected to increase 37.3% in 2026, making it the highest-growing IT segment, but at a slower rate than this year as the market shifts from rapid build-out to incremental and sustained investment (see Table 1).

Table 1. MENA IT Spending Forecast, 2025-2026 (Millions of U.S. Dollars)

|

|

2025 Spending |

2025 Growth (%) |

2026 Spending |

2026 Growth (%) |

|

Data Center Systems |

9,455 |

69.3 |

12,984 |

37.3 |

|

Devices |

32,793 |

6.7 |

35,234 |

7.4 |

|

Software |

17,949 |

11.7 |

20,452 |

13.9 |

|

IT Services |

34,061 |

6.9 |

36,894 |

8.3 |

|

Communications Services |

60,905 |

4.4 |

63,456 |

4.2 |

|

Overall IT |

155,163 |

8.8 |

169,019 |

8.9 |

Source: Gartner (August 2025)

“Data center system spending is expected to accelerate as MENA CIOs and technology leaders invest in AI-enabled software and AI-optimized infrastructure,” said Eyad Tachwali, VP, Advisory at Gartner. “This surge is largely fueled by pent-up demand for generative AI (GenAI) and advanced machine learning, which depend on robust computing power for large-scale data processing. Most of this demand is being driven by governments, hyperscalers, technology providers and organizations focused on developing and deploying AI models, rather than traditional enterprises or consumers.”

AI Integration Reshapes IT Spending Priorities in MENA

Software spending in MENA is expected to grow 13.9% to $20.4 billion in 2026, as organizations accelerate adoption of GenAI capabilities. Gartner predicts that by 2028, 75% of global software spend will be on solutions with GenAI functionality.

“CIOs will increasingly be offered embedded GenAI capabilities in enterprise applications, productivity and developer tools, more advanced large language models as well as AI-optimized servers to support AI-as-a-service,” said Burt. “Providers are also exploring new pricing models across software and hardware to drive revenue.”

As AI becomes central to innovation, its integration into software and IT services is fundamentally reshaping spending priorities across the region, with IT services spending in MENA projected to grow 8.3% in 2026.

“With the rapid acceleration of AI infrastructure and adoption in MENA, CIOs must move beyond GenAI as a productivity tool and embed it into the heart of their business strategy,” said Tachwali. “The real competitive edge will come from building strong data foundations, composable technology platforms and cultivating AI-fluent talent—core enablers for unlocking differentiated value from AI.”

Gartner’s IT spending forecast methodology relies heavily on rigorous analysis of the sales by over a thousand vendors across the entire range of IT products and services. Gartner uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data on which to base its forecast.

The Gartner quarterly IT spending forecast delivers a unique perspective on IT spending across the hardware, software, IT services and telecommunications segments. These reports help Gartner clients understand market opportunities and challenges. The most recent IT spending forecast research is available to Gartner clients in Gartner Market Databook, 2Q25 Update.