- Key drivers of future growth include training and upskilling, access to training and development support and omnichannel payments

- 36% of SMEs in Egypt expect revenues to hold steady or grow compared to 2022

By : Mostafa Ibrahim

From surviving to thriving in the post-COVID world, small and medium enterprises (SMEs) in the Middle East and North Africa (MENA) are optimistic about 2023 revenue projections; however, SMEs in Egypt are still picking up pace. These are the findings of the second edition of the Mastercard Eastern Europe, Middle East and Africa (EEMEA) SME Confidence Index.

The 2021 inaugural SME Confidence Index delved into the impact of the pandemic on SMEs across sectors, products and services, and how they are embracing a digital future. As a continuation, the second edition of the survey reveals that SMEs in Egypt view easier access to funding as the biggest opportunity for business growth.

SMEs in Egypt are cautious about the year ahead

Less than a half (43%) of SMEs in the country are confident about business growth this year compared to 2022.

As companies recover from the pandemic and return to the growth phase, the research shows that 36% of SMEs in Egypt project similar or increased revenue in the next 12 months.

Access to funding among top drivers of growth

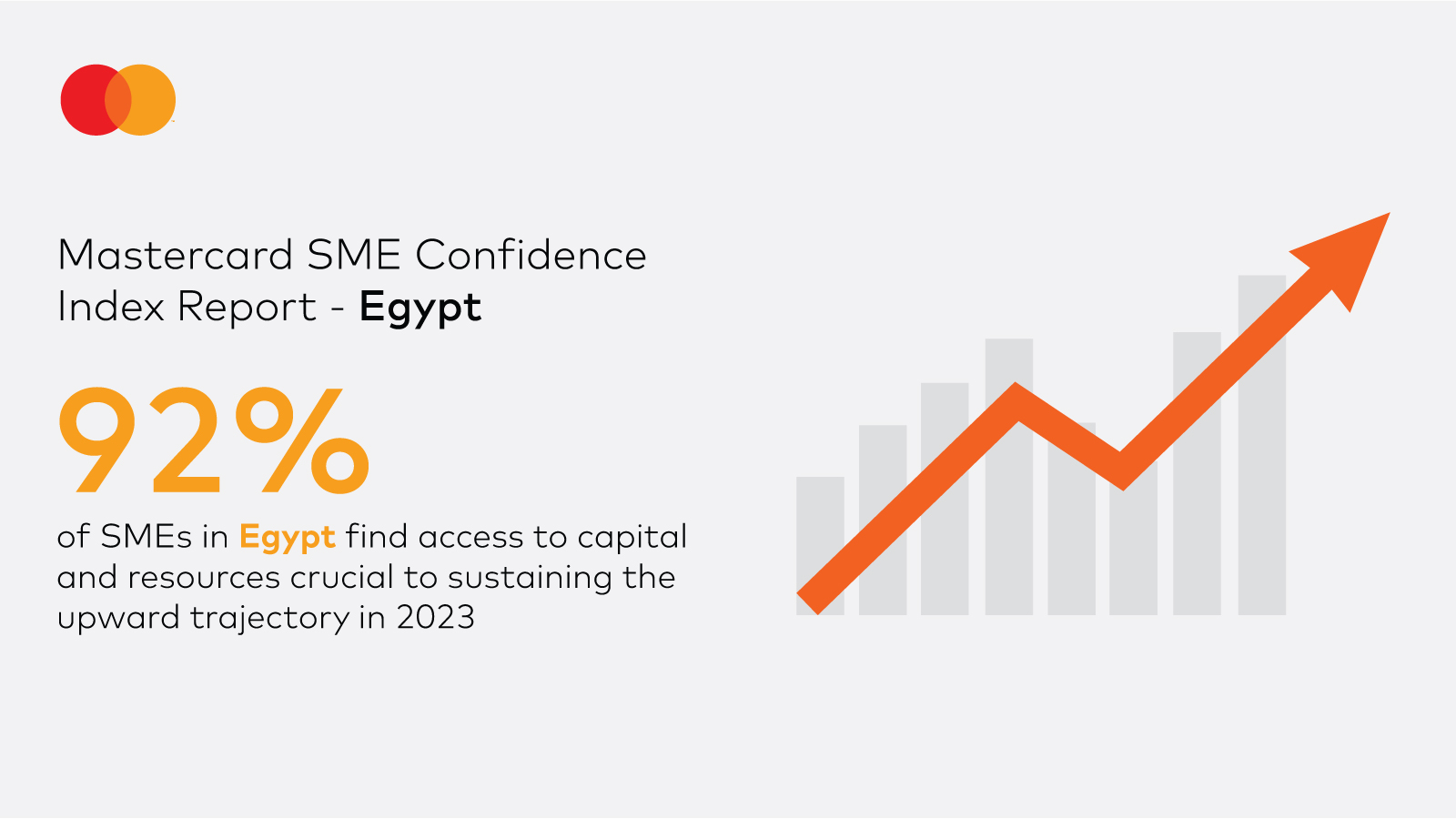

Easy access to funding remains a key factor for growth in Egypt – 92% of SMEs find access to capital and resources crucial to sustaining the upward trajectory in 2023. The International Finance Corporation (IFC) estimates the value of the total financing gap for SMEs in MENA at $210 to $240 billion.

“The latest Mastercard SME Confidence Index has highlighted the urgent need to close the SME funding gap in Egypt and empower the country’s small businesses to realize their full potential. In line with our long-standing commitment to fueling the growth of the digital economy in this important market, we are working in tandem with the public and private sector to create an enabling environment for SMEs to flourish,” said Adam Jones, Country General Manager, MENA Central, Mastercard.

SMEs in Egypt have identified training and upskilling staff (89%), access to training and development support (88%) and accepting omnichannel digital payments (85%) as other main drivers of growth.

Adoption of digital payment solutions is on the rise in Egypt, with 88% of consumers in the region having used at least one emerging payment method in the last year. Mastercard works as a trusted partner of the country’s government to enable small businesses to go digital, driving economic equality and inclusive prosperity. The company has pledged to connect 50 million SMEs worldwide to the digital economy by 2025.

Mastercard leverages its extensive network, state-of-the-art technology, and global partnerships to help SMEs to adapt to changing commercial environments and new spending patterns.

The company works with governments and the private sector to build synergies that advance financial inclusion and motivates consumers and merchants to support small businesses.