93% of businesses feel that Transfer Pricing (“TP”) as a concept is either important or very important to their group- Most multinational enterprises have either changed, will change or at least assessed changing TP policies and structures due to the OECD’s Base Erosion and Profit Shifting (“BEPS”) initiatives.

- A majority of respondents still rely on relatively manual TP processes to prepare documentation and implement TP policies.

- 53% of respondents expect there to be some changes to their TP policies or the introduction of new transactions due to COVID-19.

By ; Mahmoud El Daba - Basel Khaled

The TP landscape has changed and evolved significantly in the last 12 months. The combination of extensive new compliance requirements, a refresh of business models (also necessitated by COVID-19) and disputes with tax authorities on TP (‘TP controversies’) means that today TP in the Middle East is no longer a tax related afterthought, but instead, it has become a fundamental pillar of tax and business strategy for most groups.

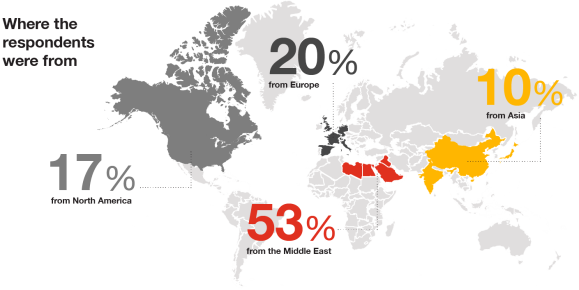

In the last year, we have seen key developments in the region, mainly in the Kingdom of Saudi Arabia, the United Arab Emirates, Jordan, Bahrain and Oman. To assess these changes and their impact on businesses, PwC has conducted a survey of over 120 finance and tax professionals globally who deal with a taxable presence for their businesses in the Middle East in positions ranging from tax managers to C-suite executives in various industries. 53% of respondents work in organisations headquartered in the Middle East, 20% in Europe and 17% in North America. The survey took place between February and June 2020 taking into account views on COVID-19’s impact on TP.

The results reflect the fact that 93% of businesses feel that TP as a concept is either important or very important to their group; and although, 81% of respondents prepare TP documentation, the approach used varies significantly. Additionally, 53% of respondents expect there to be some changes to their TP policies or the introduction of new transactions due to COVID-19.

The BEPS initiatives have significantly impacted the way multinationals approach TP and international tax matters. The focus on substance, the increased risk of creating permanent establishments, as well as significant compliance and reporting requirements means that TP models that were deemed “compliant” in the past had to be re-designed or in some cases, completely overhauled. 77% of respondents have either made or are in the process of making changes to their TP policies as a result of BEPS Initiatives. Additionally, 75% of respondents have either made or are in the process of making changes to their legal structure, ownership of intangibles or funding positions as a result of BEPS.

Another area the survey examined is the TP technologies in place for documentation and reporting purposes. It concluded that 57% of groups still follow relatively manual and unsophisticated processes using software such as Word and Excel; whilst 72% of groups headquartered in the Middle East suggested the use of a manual approach over those headquartered elsewhere. This response goes hand in hand with the fact that TP is still a maturing concept in the Middle East and as such, the initial focus has been on complying and adjusting to the new rules. As the annual process takes effect, we expect to see an increased focus on automating certain parts of the TP process, in turn giving TP and tax teams the opportunity to deliver more value to their businesses with a reduced manual compliance workload.

Mohamed Serokh, PwC Tax Partner & Middle East Transfer Pricing Leader, PwC Middle East, said: “The PwC Middle East Transfer Pricing Survey 2020 also sheds light on KSA, Egypt and the UAE providing an understanding of TP compliance and how new TP rules and Country by Country Reporting (“CbCR”) will be impacting businesses. In 2020, businesses across the region, as the rest of the world, are trying to navigate uncertainty and adapt to a new normal and the subject of TP now plays an integral part of this process from a finance, tax and ultimately business perspective as a whole.”

80% of respondents felt that COVID-19 would have a medium impact on their businesses. This is not surprising given how significant the global impact COVID-19 has had from a human as well as an economic perspective. The biggest areas of impact in relation to the respondents’ TP arrangements were: liquidity & financial transactions (33%), operations & supply chain (27%) and adapting TP policies (27%).

New and updated substance and TP regulations in the Middle East, with added pressures from the economic impact of COVID-19 as well as understanding new global developments, translates to the need for TP functions to prioritise TP actions accordingly. This is a great opportunity for businesses to revisit their TP processes to ensure that their TP arrangements are underpinned by well defined and implemented processes, where TP technology is expected to play a critical part.