By : Mostafa Ibrahim – Wael Elhosany

One Finance, a leading non-banking financial institution (NBFI) in Egypt, proudly announces a pivotal

moment in its financial history with the successful completion of its inaugural securitization bond

offering, raising a substantial EGP 616 million. This accomplishment marks the initiation of a broader

securitization bond program, aiming to reach a total value of EGP 3 billion.

The securitization bond offering comprised three tranches with varying tenors of 13, 36, and 48 months,

raising EGP 131.8 million, EGP 328.9 million, and EGP 155.3 million, respectively. Notably, all three

tranches received a P1 (SF) rating from MERIS Ratings, underscoring a high level of credit quality.

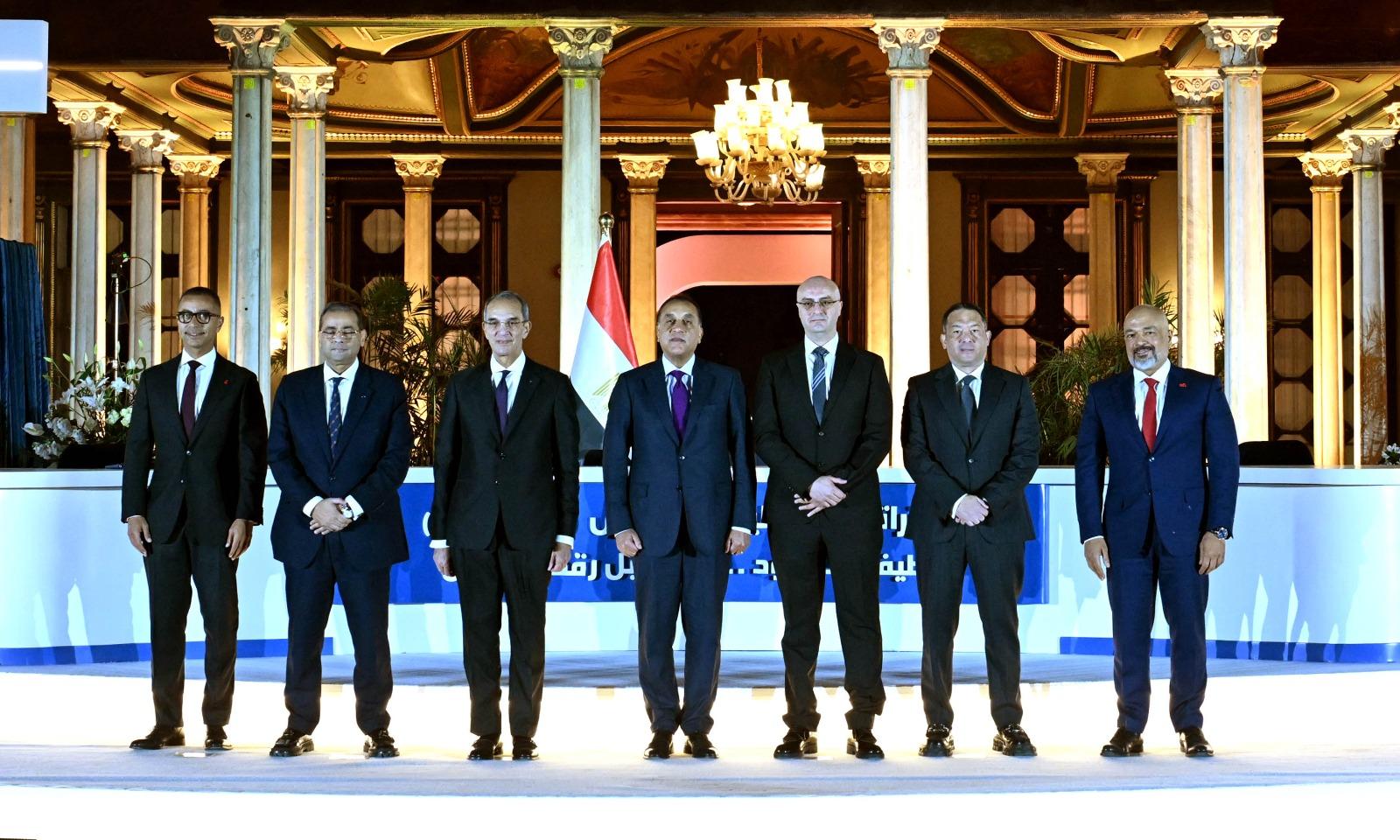

Hazem Madany, Chief Executive Officer and Managing Director of One Finance, positioned the

completed offering as a crucial step within a larger EGP 3 billion securitization bond program. Madany

outlined the strategic goals that the proceeds from the issuance will support, including expanding

capabilities, introducing new products to enhance client purchasing power, diversifying the product

portfolio, and fostering sustainable growth and profitability.

Amr Abdelmaksoud, the Chief Financial Officer of One Finance, emphasized the strategic importance of

a successful securitization, highlighting it as a vote of confidence from financial partners. He outlined the

company's intention to leverage the funds raised to diversify its product offerings, achieve sustainable

growth, and bolster liquidity levels.

Key financial institutions played pivotal roles in the success of this securitization. CIB served as the sole

financial advisor, transaction manager, book runner, and arranger. AAIB, in collaboration with Al Baraka

Capital, acted as underwriter and the custodian bank. Dreeny & Partners provided legal advisory

services, while Baker Tilly served as the auditor. Noteworthy subscribers to the issuance included AAIB,

ABC Bank, Al Baraka Bank, CI Capital, and AAIM.

One Finance is established in 2022 as a licensed consumer finance company by the FRA, One Finance

operates as a shareholding company in partnership with Ayady for Investment and Development,

Tamweely for Microfinance, and Post for Investments.