By: Amir Taha

The European Telecommunications Network Operators’ Association (ETNO) and the GSMA, representing Europe’s telecom operators, and the European Network Airlines’ Association (ENAA), the leading network airlines’ association, take note of DG COMP’s staff report on “Protecting competition in a changing world”.

Healthy and sustainable competition drives innovation and investment, which in turn impacts competitiveness and the wellbeing of citizens. Our members, day in day out, fiercely compete to innovate in their respective sectors and to provide choice and quality to European citizens and businesses. But there is a limit to our members’ ability to invest when many of them are operating below costs of capital. The experience of our member organisations indicates that the EU has significant margin to improve its competition policies to drive EU competitiveness and a true Single Market, so that it can fully meet today’s economic and social challenges also at a global level.

Airlines

EU network airlines, with their hubs in Europe, serve the EU’s strategic interests by ensuring intra-European and global connectivity both for people and goods. Our hub-and-spoke model enables a large network of connections, ensuring that even the most remote European cities and regions can be fully connected to a multitude of destinations across Europe and the world.

ENAA members stand in fierce competition with non-EU carriers, which are often state-owned and subsidised, or benefit from competitive advantages due a more favourable regulatory framework. While the EU’s legislative landscape should safeguard and promote the competitiveness of European industries, the opposite is currently true. As a consequence, European network carriers in the past 10 years have continuously lost market shares namely on the EU-Asia and the EU-Africa routes against carriers from the Gulf region and Turkey.

Telecommunications

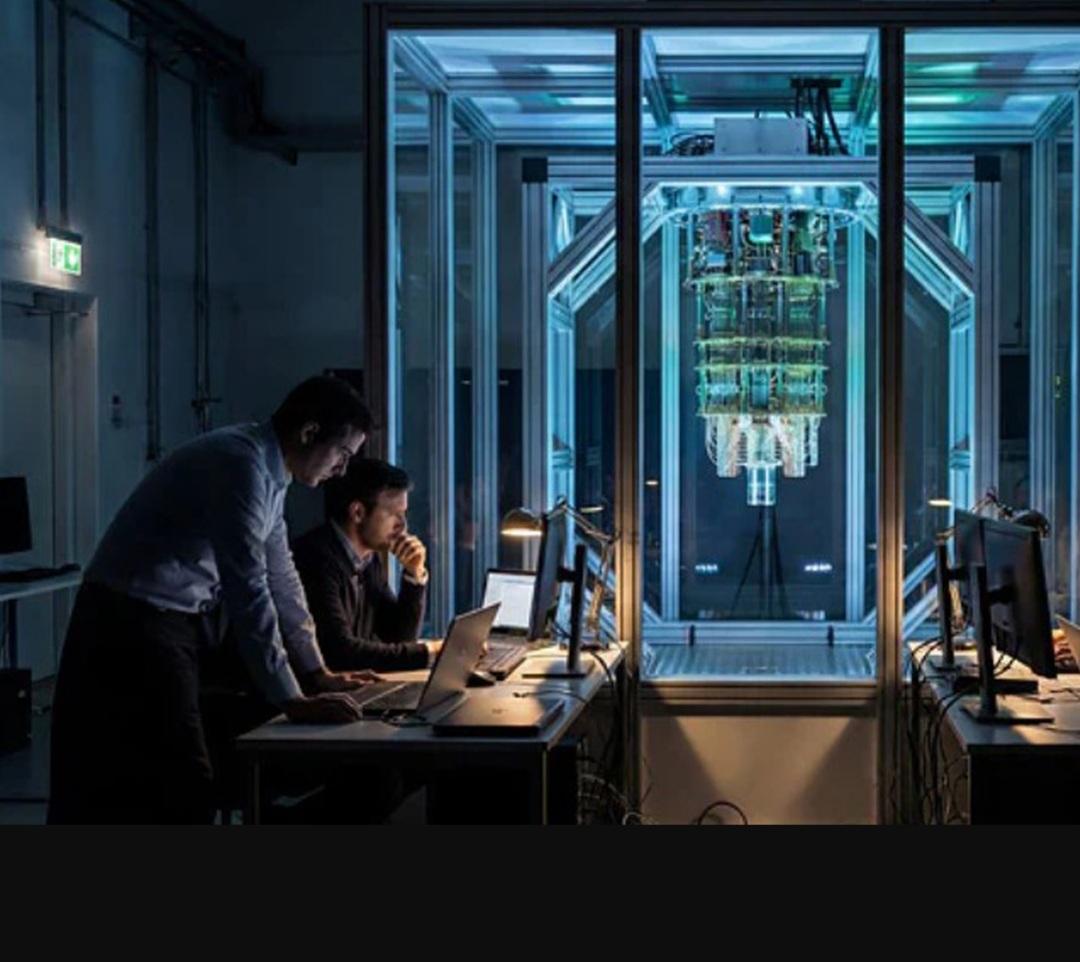

Europe currently has the lowest telecoms investment-per-capita of all major regions, including thriving markets such as South Korea, Japan as well as the US. This has led Europe to trail globally in both 5G roll-out and innovation in connectivity, resulting in lower quality of services and digital adoption. This harms competition and the welfare of consumers who are not able to access the latest technologies and innovative services in the mid to long-term.

We note that the report, however, found that positive effects on investment in networks in more concentrated markets could not be reliably discerned in the mobile telecommunications industry. In addition, the report makes a comparison between the EU and U.S., showing that the level of investment in the U.S. has been consistently larger than in the EU, but with higher average revenue per user (ARPU) than in the EU.

We disagree with the findings of the study, which suggest that higher concentration is associated with lower investment, or at least not with higher investment. This is contrary to recent GSMA studies which have shown that the link between lower concentration and reduced investment per operator is statistically significant and robust across various methods and checks. Our view remains that in-market consolidation and three player markets yield more investment, which means that consumers will be paying for better quality products and services.

We also disagree with the findings that consolidation in mobile telecoms tends to lead to higher prices for users. In reaching its conclusions on pricing the report relies only on ARPU in order to measure prices. This is because ARPU ignores the amount of data traffic consumed which is a critical element in assessing the quality of consumer products and services.

As outlined in Enrico Letta’s report, European companies in general need to achieve scale to enhance their competitiveness: “Today, European companies suffer from a stunning size deficit compared to their global competitors, primarily from the United States and China.”

We agree with Letta’s Report, and we believe that a long-term view focused on investment strategies that boost EU competitiveness and prosperity should be urgently integrated into the thinking and the decision making of DG COMP. This would be to the benefit of European citizens, defined as more than mere consumers of products and services concentrated only on price. For this reason, our sectors join forces today to put forward a strong, united and urgent call for competitiveness, resilience, investments, innovation, security and connectivity, and for sustainable growth to be taken into account at last when developing and implementing EU competition policy. Strong European economic sectors will be able to provide sustained employment to our citizens as well as access to latest technologies, high quality products and services, more choice and innovation.

As highlighted by the DG COMP Study, one of the primary drivers of the evolution of competition within the EU is the implementation of pro-competitive regulatory reforms. We strongly support this conclusion. These reforms should be undertaken, as always, in an open dialogue with the relevant industries and by considering available sectoral data from all stakeholders involved, to develop the most effective regulatory solutions.

Taking a forward-looking approach, we would be happy to contribute to the fact finding on the current status and the future of the sectors. We would be pleased to work constructively with competition authorities and policymakers at the European Commission to find an approach which allows to have more sustainable and financially solid European actors that are able to continuously invest into better services, more choice and innovation. The promotion of truly effective private-public cooperation is key at a time when the future policy direction for the new mandate is crafted, especially at this challenging moment for the EU’s competitiveness and economic progress.