- The "Damen" network is fully secured and not connected to the Internet, and customer data is stored in the company's data centers

- Launching the "Damen Cash" application before the end of 2024 to develop the digital payments market

- The company is one of the 5 largest Egyptian companies providing digital payment services

Conducted by: Khaled Hassan

Prepared for publication: Bakinam Khaled

Sameh El-Mallah, CEO of Damen Electronic Payments Company, confirmed in response to a question from "Alam Rakamy" that the company is indeed planning to be present in foreign markets, especially The markets of the Arabian Gulf region to serve Egyptians in these markets to transfer its expertise gained from its presence in the Egyptian market to enhance the infrastructure of digital payments, especially in light of the success in developing the non-cash support system in cooperation with the Ministry of Supply and Internal Trade over the past years.

The size of the Egyptian market for electronic payments currently exceeds about one trillion pounds and is expected to grow by 25% over the next ten years in light of the great interest witnessed by the Egyptian government in accelerating the digital transformation process for all its services to citizens and relying on digital payments to facilitate the provision of services to citizens and doubling the number of users of cards and credit cards to about 35 million cards, not to mention the "Instapay" application, launched by the Central Bank of Egypt, which represents a qualitative leap in the number of users of digital payments in addition to the role of leading companies such as the role of "Fawry" in developing the market.

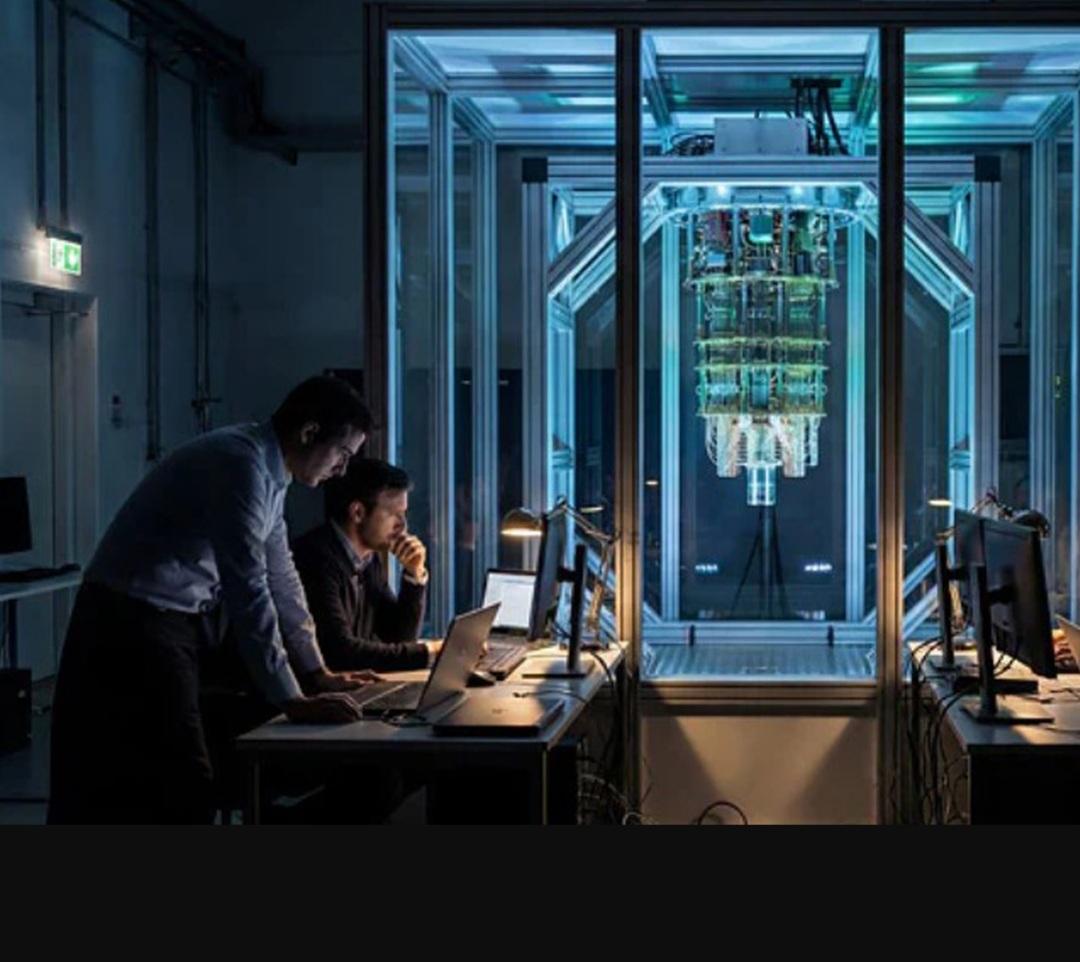

Encrypting transactions

This came during the activities of the press conference organized by the company today on the occasion of the 5th anniversary of the launch of electronic payment services in the Egyptian market. In response to a question from "Alam Rakamy", he said that encrypting financial transactions is one of the most important requirements for gaining the trust of customers, individuals or institutions, in electronic payments. Therefore, the company relies on a completely closed network, away from the global Internet, so that all transactions and financial movements are stored through a data center specific to the company and it is difficult to hack it through electronic attacks.

He added that with the company preparing to launch its financial application "Dhamen Cash" for electronic payments, before the end of this year, it has a partnership with a number of major international companies specialized in the field of information security to secure all financial transactions that will be carried out in this application, which will certainly be connected to the Internet, and all these financial transactions will be encrypted and an integrated strategy will be implemented to prevent any hacking of our customers' data.

Electronic payment and additional fees

In response to a question from "Alam Rakamy" about the possibility of applying contactless payment technologies, Al-Mallah explained that the technology is already present and applied in a number of countries around the world, and we look forward to starting its application in the Egyptian market once we obtain approval from the regulatory and financial authorities concerned with applying this technology.

In response to a question from "Alam Rakamy" about the citizen bearing an additional financial cost for relying on electronic payment, especially for government services, the CEO of "Dhamen" for electronic payments said that government agencies cannot impose any additional fees on citizens except through a law from the People's Assembly, so the existence of electronic payment companies to provide their services requires them to obtain simple fees in exchange for the continuation of the service and work on improving it in a way that saves the citizen the cost of transportation and waiting in cash payment queues.

Qualifying human cadres

In response to a question from "Alam Rakamy" about the company's interest in training human cadres, Al-Mallah said that one of the company's interests is to build a large base of human cadres specialized in the field of electronic payments, as we periodically train dozens of human resources, as the company has a research and development center that develops all the company's solutions. We also have global agreements and partnerships to qualify our employees on the latest technologies in the field of digital payments to contribute to developing the Egyptian market and transferring global expertise to the local market.

Supporting entrepreneurship

In response to a question from "Alam Rakamy" about the company's interest in supporting entrepreneurs and innovators, Al-Mallah said that we actually have a vision and an integrated program for social responsibility that aims to help owners of creative ideas develop new solutions to specific problems that the cashless payment community suffers from, and this is what we look forward to expanding by enhancing cooperation with universities, entrepreneurs, and emerging companies specialized in the field of financial technology.

Quantum leap

In response to a question from "Alam Rakamy" about the impact of the possibility of the Central Bank of Egypt providing "cross-border transfers" services via electronic payment for Egyptians residing abroad through its "Instapay" application, Al-Mallah said that it will constitute a very, very large qualitative leap for the size of the Egyptian market for digital payments, as remittances from Egyptians abroad reach about 33 billion dollars, and electronic payment companies will have a very important role in delivering these remittances to the families of Egyptians abroad through their branches spread widely throughout the republic.

Competition

The CEO of Daman Electronic Payments Company confirmed that there are about 260 companies operating in the Egyptian electronic payment market, with different sizes, specializations and geographical spread. However, with the passage of time and with the maturity of the market, it is expected that there will be a merger or partnerships between these companies so that we will have a smaller number of companies operating in the field of providing digital payment services in a more efficient and experienced manner and providing many services to both the end customer and the merchant as well.

It is worth noting that “Damen” is a company specialized in providing integrated technology solutions. “Damen” has more than 23 branches across Egypt’s governorates, and provides more than 600 electronic payment and collection services through the “Damen” payment platform, such as donations to charitable institutions and associations, charging electricity cards and gas bills, paying mobile phone and landline bills, and providing its services through a network of more than 120,000 merchants in all governorates of Egypt. The volume of “Damen” digital payment network operations amounted to about 14 billion pounds in 2023 and is expected to exceed 20 billion pounds by the end of this year, while the number of points of sale amounted to about 120,000 points of sale.