- 94% of consumers in Egypt are considering emerging payments such as biometrics, digital wallets, transfers and QR codes, in addition to Contactless, according to the Mastercard New Payments Index

- 83% of consumers in Egypt have access to more ways to pay compared to this time last year

- 3 out of 4 Egyptian consumers say digital payment methods help them save money

- 68% of shoppers in Egypt say they are more loyal to retailers who offer multiple payment options, and would shop at small businesses that offer more diverse ways to pay

By : Mohamed Shawky

As the world went into pandemic lockdown in 2020, consumers shifted their spending habits to embrace contactless payments and online shopping. As stores closed and social distancing took hold, retailers worldwide moved their businesses online, embraced e-commerce and explored the potential of new ways to pay.

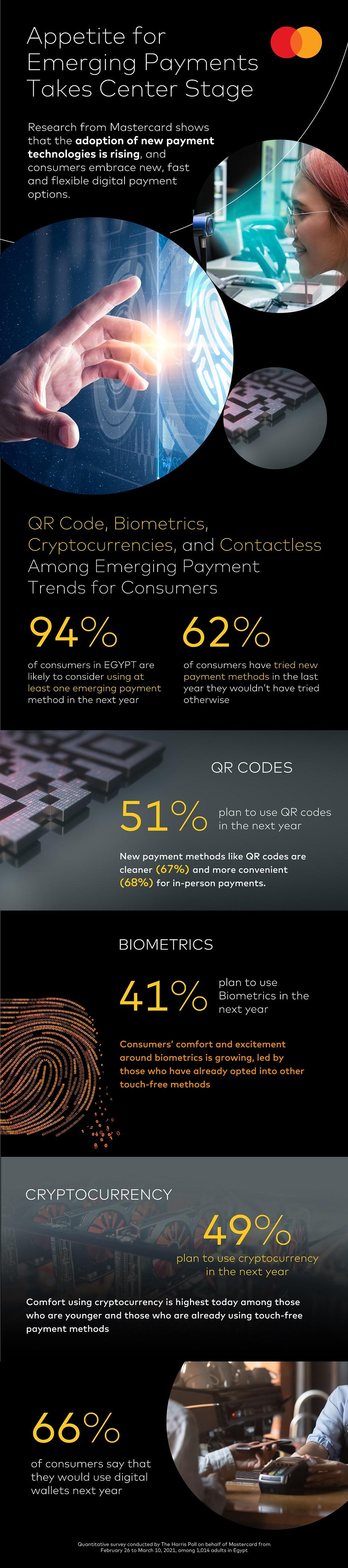

More than a year later, research from Mastercard shows that the adoption of new payment technologies is rising, and consumer appetite for new, fast and flexible digital experiences continues to grow.

The Mastercard New Payments Index shows that 94% of consumers in Egypt will consider using at least one emerging payment method, such as cryptocurrency, biometrics, contactless, or QR codes, in the next year.

Over two-thirds of respondents (62%) agree that they have tried a new payment method they would not have tried under normal circumstances, suggesting that the pandemic has galvanized people to try flexible new payment options to get what they want, when they want it. With this interest and consumer demand also comes a greater expectation for businesses to provide multiple ways to shop and pay. In fact, more than half (53%) of consumers in Egypt say they would avoid businesses that do not accept electronic payments of any kind. Additionally, nearly 3 out of 4 (72%) Egyptian shoppers say that digital payment methods help them save money.

“The pandemic made us think differently, partly out of necessity,” says Craig Vosburg, Chief Product Officer at Mastercard. “To deliver the choice and flexibility that consumers need – and increasingly expect – retailers worldwide need to offer a range of payment solutions that are easy to access and always on. As we look ahead, we need to continue to enable all choices, both in-store and online, to shape the fabric of commerce and make the digital economy work for everyone.”

Globally, contactless technology was the digital catalyst to explore new payment options because of its fast, secure and touch-free experience. Between the first quarter of 2020 and the same period in 2021, more than 100 markets saw contactless as a share of total in-person transactions grow by at least 50 percent. A year into the COVID-19 pandemic, contactless is showing its staying power and dynamism – in the first quarter of 2021 alone, Mastercard saw 1 billion more contactless transactions worldwide as compared to the same period of 2020. All signs point to a continued growth path for contactless, with nearly 7 in 10 consumers globally anticipating using a contactless card this year.

Khalid Elgibali, Division President, Middle East and North Africa, Mastercard, revealed the findings during an official executive visit to the market.

“As we see greater consumer demand for emerging payment technologies, it is not only beneficial but essential for businesses to stay ahead by offering a broader range of payments options to shoppers. We are working closely with our partners and the government of Egypt to roll out the latest in digital payments, ensuring that the people of Egypt benefit from the convenience, simplicity and security that digital solutions offer.

Together, we are building a more connected, more inclusive future for everyone,” said Elgibali.

Looking to the future, digital currency wallets and money transfers, biometrics, contactless and QR codes are trending as emerging payment technologies as people’s comfort and understanding of these increase and the use of cash decreases.

In fact, 83% of consumers in the region have more ways to pay compared to this time last year. The exploding interest in new payment technologies is likely to further encourage businesses to expand their options at checkout.

The Mastercard New Payment Index further found:

- Cryptocurrency1 Gains Ground – Today consumers can buy, sell, and trade cryptocurrency as a commodity or investment. Consumers are also increasingly showing interest in being able to spend crypto assets for everyday purchases. As global interest in digital currencies continues to accelerate, 49% of consumers in Egypt say they plan to use cryptocurrency in the next year, with more than six in ten (62%) noting they are more open to using it than they were a year ago. While consumer interest in cryptocurrency - especially floating digital currencies such as Bitcoin - is high, work is still required to ensure consumer choice, protection, and their regulatory compliance. Earlier this year, Mastercard announced that it will start supporting select cryptocurrencies directly on its network.

- Biometric Payments are More Trustworthy - 4 in 10 (41%) Egyptian consumers say they plan to use biometric verification methods like gait or walk assessments and fingerprint authorization. In fact, over 6 in 10 people (62%) feel safer using biometrics to verify a purchase than entering a pin.

- QR Codes are Cleaner and More Convenient – Growing markets are leveraging QR-based options as a clean and convenient way to interact with merchants. 51% of people in Egypt expect to use more payment technologies like QR codes in the next year. Consumers also find that that QR codes are cleaner (67%) and more convenient (68%) for in-person payments and have a significant potential to reduce cost of payment acceptance and increase financial inclusion.

- Digital Wallets and Money Transfers Surge in Popularity – As digital wallet services continue to proliferate in the region, the technology has seen a surge in popularity. 66% of Egyptian consumers say that they would use digital wallets next year, while 65% say they plan to use digital money transfer services.

To Meet People’s Demands, Businesses Expected to Embrace Emerging Payment Trends

With enhanced consumer interest around new payment technologies, the expectation for businesses to adapt for the long-term is here to stay. Over three in four consumers in Egypt (73%) say that they prefer to shop at businesses that have both an in-person and online presence, and 74% noted being more excited to shop at retailers that can offer the latest payment methods. 68% said they would be more loyal to retailers who offer multiple payment options.

This behavior shift is reinforced by the desire for consumer choice, with 72% saying that they expect to make purchases when they want and how they want. The businesses that can provide multiple ways to shop and pay are best positioned to meet these expectations. As the demand of emerging payments and choice continues, it requires a wider range of payment solutions, insights, and products to meet the accelerating enthusiasm of the future state of pay.