- Usama Zaki: “Raya Has Designed a Business Model to Reduce over 10 Million Tons of Carbon Emissions Annually through Green Transformation of the Two Wheelers Vehicle Market and We Call upon All Stakeholders to Cooperate”

By : Amir Taha

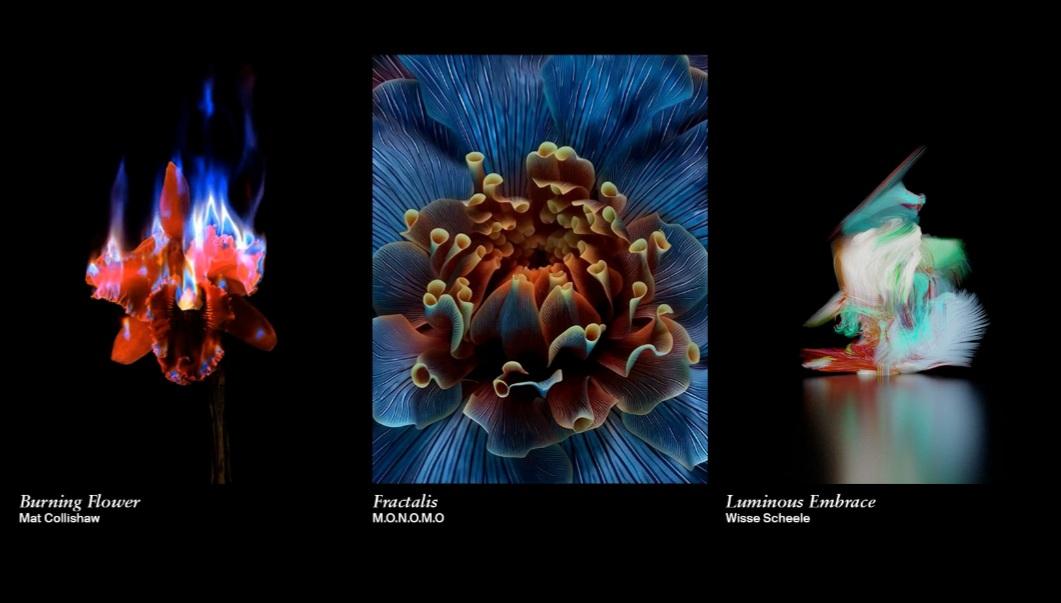

Raya Holding for Financial Investments has announced a number of its current and planned efforts aimed at achieving sustainability and green transition, particularly through its operations in the financing and manufacturing sectors. This was during a side event at COP27, entitled “How to Scale Green Microfinance in Egypt and Africa?”

The event, held in the Egyptian Business pavilion in the Blue Zone, in Sharm el-Sheikh, Tuesday 8th of November, delta with the role of various key actors to promote green transition through financing small and micro businesses. It has also highlighted the key role of the financial sector locally and internationally, frameworks governing the microfinance sector, and how to utilize microfinance to achieve green transformation across many industries.

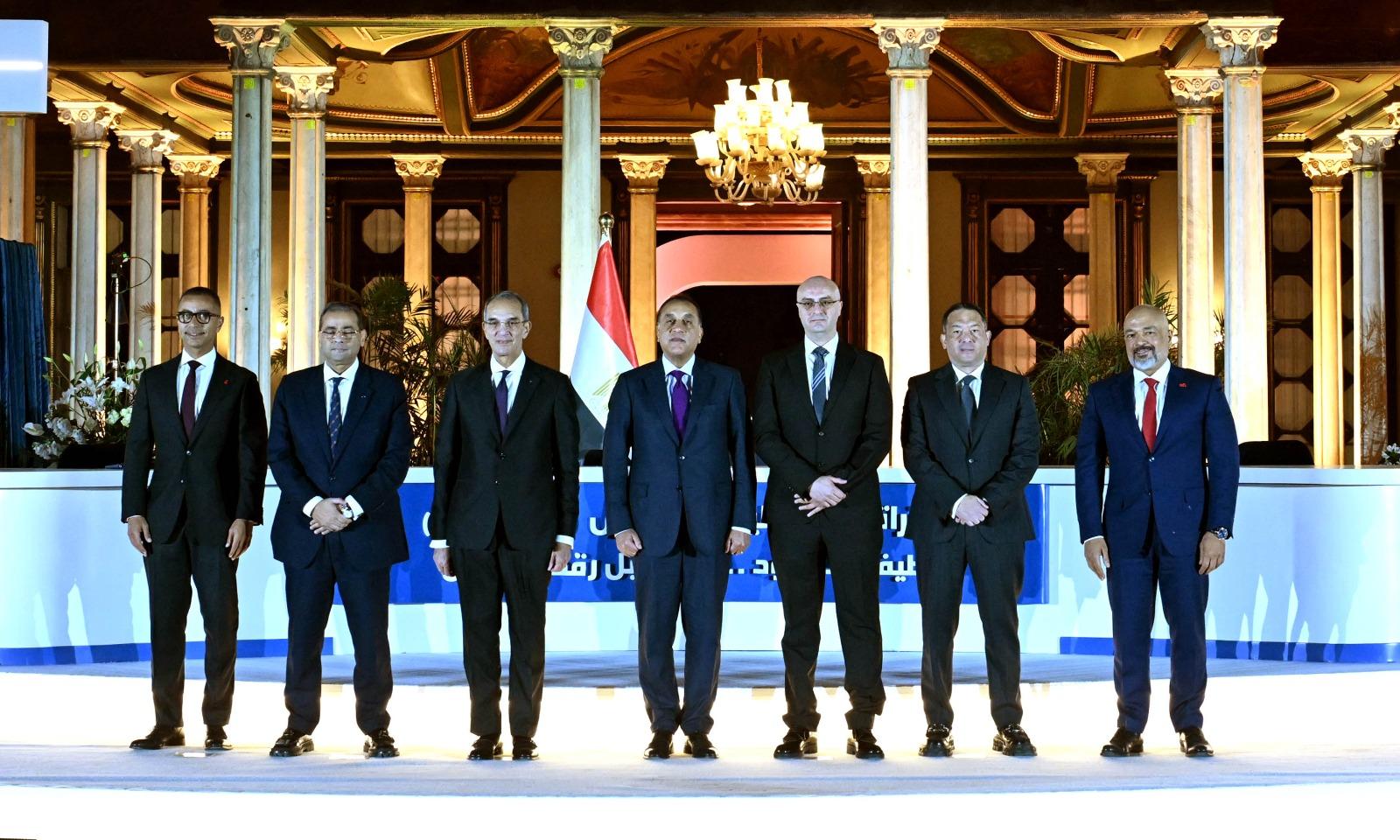

The event was held with the high-level participation of Mr. Mohamed Farid, chairman of the Financial Regulatory Authority and vice chairman of (IOSCO), Mr. Ahmed Kouchouk, Vice Minister of Finance for Fiscal Policies and Institutional Development, Mr. Yehia Aboul Fotouh, deputy chairman of the National Bank of Egypt (NBE), Ms. Maya Hennerkes, Director of Green Financial Systems at the European Bank for Reconstruction and Development (EBRD), Eng. Hazem Maghazy, CEO of Aman Holding, a subsidiary of Raya Holding, and Eng. Usama Zaki, CEO of the Manufacturing Sector at Raya Holding.

Usama Zaki said, “Green transformation is a long-term process that requires collective action.” He also called for the cooperation of all stakeholders concerned with environmental sustainability, in the public and private sectors, international entities, and the banking sector. Meanwhile, Moghazy underlined the importance of developing green financial products that benefit the end user directly, noting that it is a significant enabler to achieve green transformation.

An Ambitious Plan

Zaki Added: “Operating in over 11 diverse industries, Raya strives to leverage on its diverse expertise and know-how across different lines of business to effectively contribute to the sustainable development goals and to the green transformation, especially by using its financial services offerings and its capacities in manufacturing light transport vehicle.” Given the direct impact of the transportation sector on carbon emissions, governments set their sights on this exact sector to achieve green transformation. Meanwhile, Raya is keen to transform the two wheelers vehicle market into an eco-friendly one - which aligns with the governmental agenda aiming at reducing carbon emissions generated by the transport sector by 2030, he continued.

Zaki said that Raya is now developing a business model aiming at the two wheelers vehicles - numbering over 5 million vehicles and expected to reach 8 million vehicles by 2030 and currently generating nearly 25 million tons of carbon emissions - into green vehicles. By utilizing our capacities in manufacturing and green finance to transform half of the aforementioned numbers, we should have a remarkable impact on the environment, by reducing over 10 million tons of carbon emissions annually. Besides, through this practical model, we can witness a remarkable socio-economic impact by improving the lives of the owners of these vehicles, helping them save up to 80% of expenses spent to operate and maintain their vehicles monthly, besides a macroeconomic impact - saving over 5 billion liters of petrol, helping to save fuel subsidies, he added.

“We call on all stakeholders concerned with green transformation and climate adaptation to work hand in hand with Raya on transforming the light vehicle transport sector into a green one,” urged Zaki.

Opportunities and Challenges

“The green microfinance sector has great potential and some challenges,” said Moghazy, noting the potential of the extended market size - with the number of microfinance beneficiaries reaching 5.5 million, and expected to grow steadily to reach up to 10 million beneficiaries by 2030. Besides, the rapid growth rate of microfinance in Egypt is also a notable advantage - with the annual growth rate of the microfinance industry reaching 40%.

Yet, it is also faced with challenges that take all stakeholders to address, such as the lack of public awareness of the need and benefits of green transformation. Therefore, green products and services should be designed and introduced to benefit the end users directly and improve their lives financially. This is how we can effectively engage the public in green transformation. Another challenge lies in the higher risk of financing new green products or projects compared to other projects, and the relatively lower return on investment (ROI).

Work is Already Underway

Moghazy continued: “We believe there exists a responsibility on our shoulders to promote green transformation through green financing. Thus, we have launched several initiatives aimed at accelerating green transformation, such as Aman’s self-help initiative to transform petrol-powered vehicles to work on natural gas. In the pilot phase, we independently transformed nearly 4000 vehicles through no-interest loans to encourage customers to engage in green transformation efforts.”

Meanwhile, Usama Zaki has voiced his optimism about the efforts aiming at promoting green transformation introduced by various financial key players. “Raya aspires to take tangible steps in its project to transform the light-vehicle transport sector into an eco-friendly one and to share its success and the roadmap for long-term efforts in this regard in COP28,” he said.