By : Gabrielle Indrieri

spoke at the SAP Concur Day conference hosted in Dubai

Global business travel spending has increased by 47% year-on-year as the world recovered from the pandemic. In the Middle East and North Africa (MENA), the travel industry benefited from one of the strongest recoveries with arrivals in the Middle East reaching 83% of pre-COVID numbers. “While this uptick is expected to continue in 2024, businesses need to tap into technology to mitigate current challenges and take advantage of trends,”

These benefits are reflected in Concur’s research which reveals that businesses recognize the importance of the relationship-building opportunities that in-person connections enable (46%) and the productivity associated with face-to-face meetings (41%).

To help businesses plan for the future, here are four key areas to focus on when it comes to travel:

1. Data is king

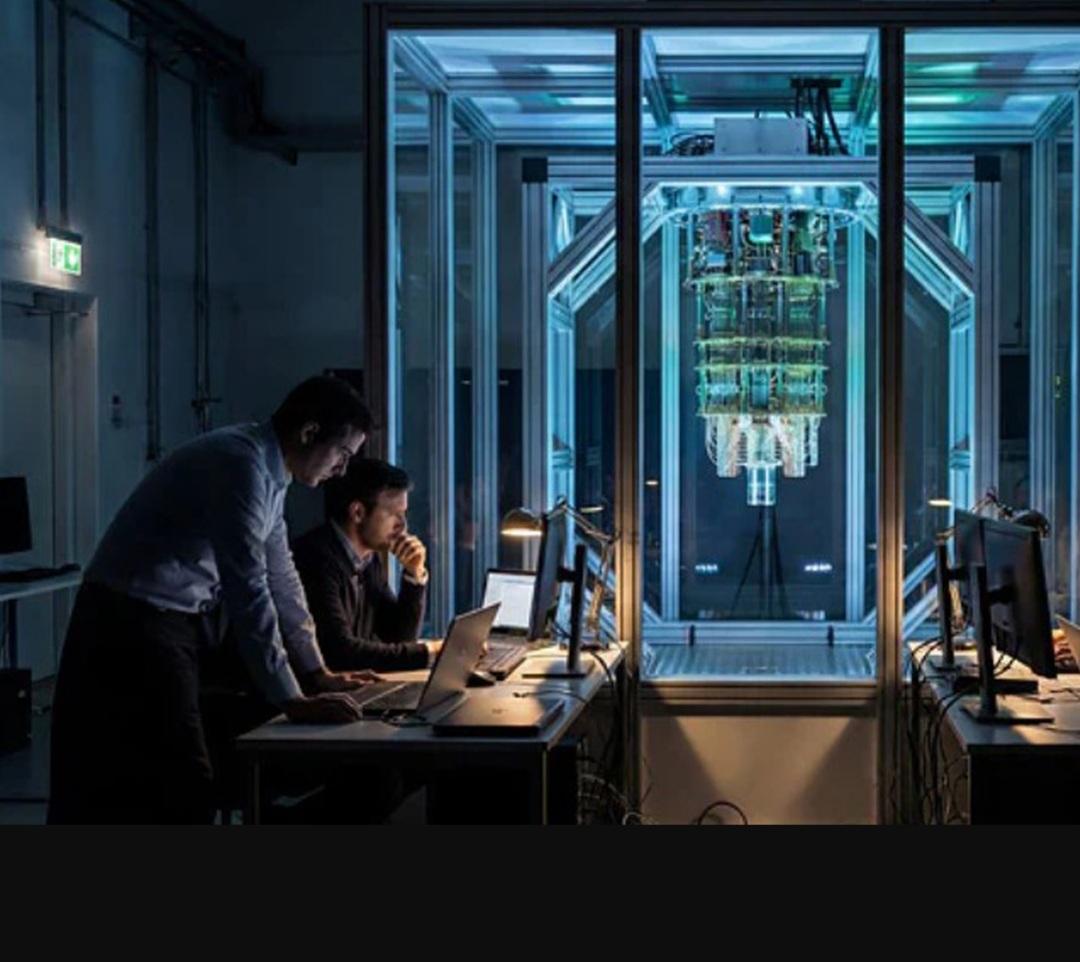

The way companies gather, and aggregate data is instrumental in shaping their future business travel strategies. Integrating travel, spending, and expense management can be a game changer. Historically, travel data originated from travel agencies, and expense data added another layer to the complexity. Now, the introduction of a new dimension, environmental, sustainable governance (ESG) data, poses a challenge in consolidating these diverse datasets. This, however, presents a significant opportunity for technology, with artificial intelligence (AI) and automation playing pivotal roles.

While businesses are gearing up to incorporate AI into their operations within the next five years, the real silver bullet lies in the quality of the data collected. It's not just about acquiring the technology but ensuring the accuracy and reliability of the data within the specific company context.

Preparing the right data sets is crucial, especially with an eye toward the imminent integration of AI. This is relevant not only in general business applications but is particularly pertinent in emerging areas like sustainability data, where companies are now treating it with the same significance as financial data.

2. Connecting the dots

The aspiration to combine sustainability data with spending, business, and employee data is widespread, aiming to create a comprehensive overview. However, the challenge lies in seamlessly connecting this data in one centralized location. This task is not only intricate but also challenging to execute at scale, becoming even more critical as companies expand globally.

In essence, the ability to connect data across different clusters becomes a defining factor. This connection not only resolves issues related to expenses and business operations but also enhances the capabilities of finance departments, positioning companies to leverage vital technology and comply with emerging regulations.

Looking to the future, the simplicity of linking data is a cornerstone not only for resolving immediate challenges but also for building the sustainability of businesses amidst ever-evolving technologies and compliance standards.

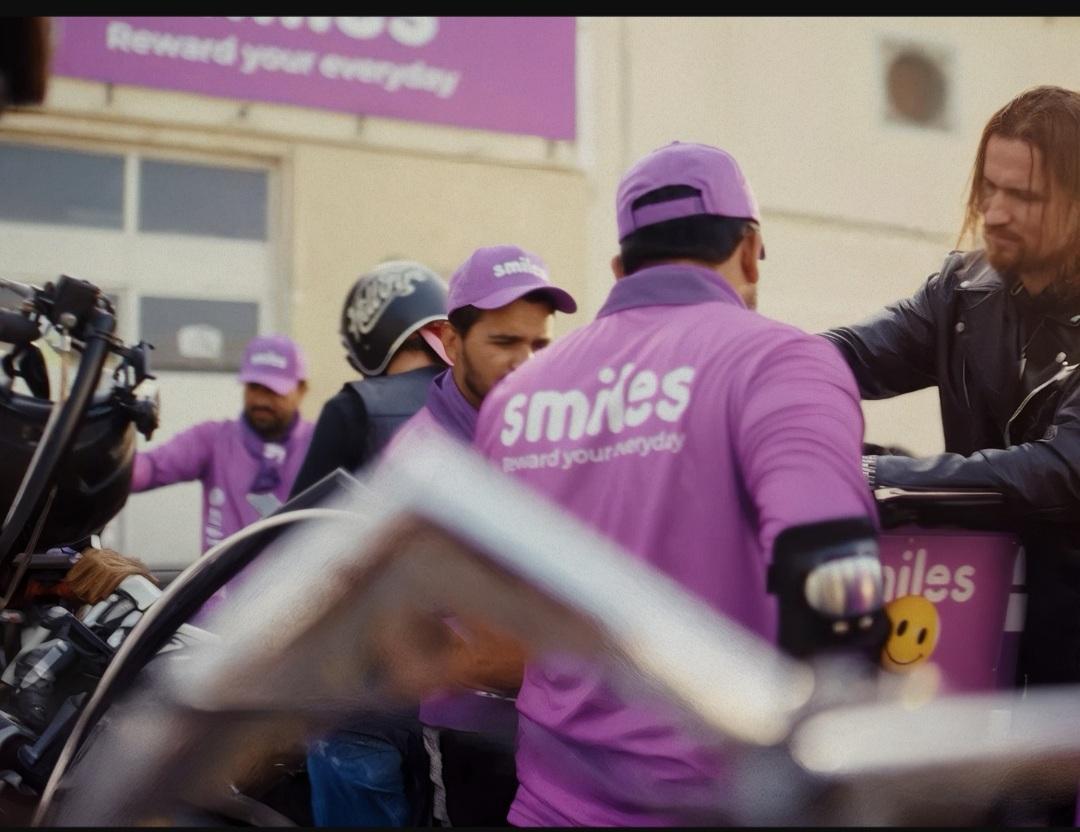

Transitioning to the mobility market, no single entity, whether travel agencies, financial players, or technology giants, is deemed sufficient. This market operates as a complex business network, interwoven by various entities like suppliers, customer ecosystems, and service companies. Technology's role here is not to replace existing players but to act as a connector, fostering collaboration.

3. Tapping into trends

Business travel has undergone significant changes, particularly in the lodging sector, as a result of the COVID-19 pandemic. This caused many individuals to leave the ecosystem, and although the volume of travel has resumed to pre-pandemic levels, not everyone has returned. For instance, fewer people are travelling, but those who are, opt for slightly longer stays.

The challenge lies in connecting this trend with the regulations surrounding sustainability, which vary globally. While the regulatory landscape poses difficulties for companies, there is a unanimous understanding that improving sustainability and reducing CO2 impact at hotels is crucial. This becomes even more challenging with the resurgence of travel volumes to pre-COVID levels.

Among the top trends, the adoption of security measures is noteworthy, especially the need for personal, in-your-pocket, and private security solutions. This enables travellers to assess risk levels when abroad, fostering a safer environment, particularly for women.

Sustainability is a key focus, given that it is estimated that business travel contributes to approximately 2% of the world's GDP. This places the business travel community on par with the contribution of the entire country of Germany. Moreover, 90% of emissions from most companies are categorized as level three emissions. Therefore, businesses need to move beyond mere ESG reporting and heed the call for significant climate action by transforming the way people travel, thereby reducing emissions and carbon footprints.

4. Banking budget

Despite the return of travel volumes, convincing every CFO to allocate budgetary resources is not an easy task. This has led to the emergence of roles such as travel and expense managers, driven by the visibility provided by data analytics.

“As someone with experience as an advisor, I understand the significance of reporting, but I believe sustainability is reaching a tipping point where actions speak louder than just the next report. Changing people's behaviour is complex, involving substantial change management. However, it is a necessary step towards achieving sustainability goals,