By ; Nahla Makled

Investments in the environmental, social and governance-based (ESG) landscape are expected to remain on a growth trajectory in 2021.

According to the research data analyzed and published by ComprarAcciones.com, ESG funds will double in 2021. Over 12% of investors who have yet to invest in ESG will start investing during the year, driving the uptick. An additional 17% will make the move in 2022 or thereafter, sustaining growth.

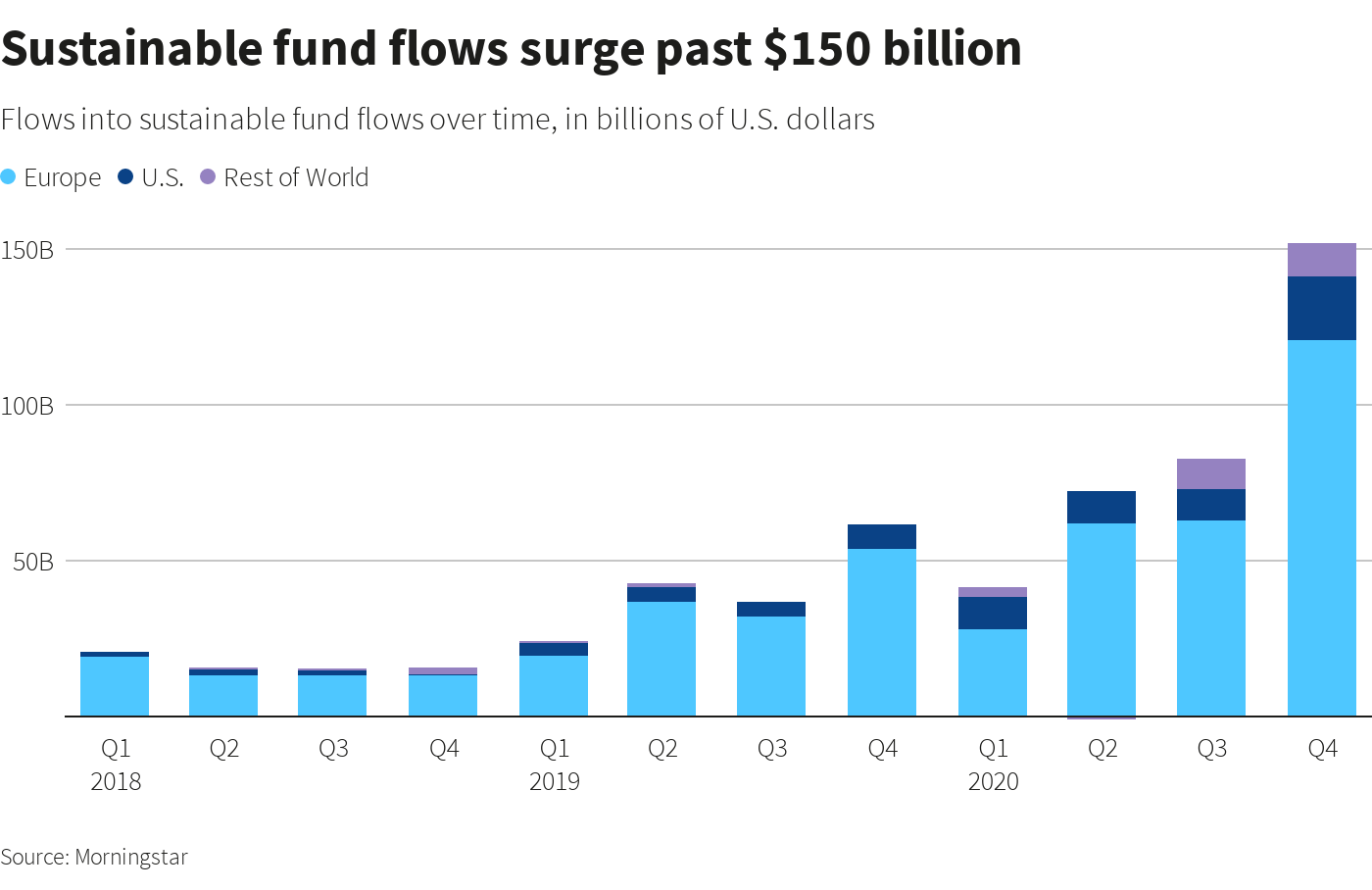

Based on a study by Morningstar, there was a massive surge in ESG funds in 2020. In Q4 alone, ESG assets under management rose by 29% reaching $1.7 trillion.

Asia’s ESG-Related Funds to Grow by 20% in 2021

Growing interest in sustainable funds in 2020 was linked to investors’ search for resilient investments. Governments are increasingly pushing for shifts to a lower-carbon economy, favoring the sector.

In Q4 2020, funds flowing into ESG investments surged by 88% to $152.3 billion. Europe led the global growth, accounting for about 80% of the worldwide total at $120.8 billion. The US was second with a 13.4% share or $20.5 billion. Funds across Asia, New Zealand, Canada and Australia amounted to $11 billion.

Japan is the lead country in Asia. According to Bloomberg Intelligence, it accounts for about 80% of the $40 billion in ESG funds trading on exchanges.

China holds a 10% share but after posting the fastest growth on the continent, is expected to dominate. Over the past two years, its ESG assets under management shot up by 1,700%. The country will contribute to a 20% growth in Asian ESG funds in 2021.

In the US, new investments into sustainable funds hit a record high of $51.1 billion. It was more than double the 2020 total and marked the fifth consecutive year of record growth. Refinitiv’s report states that US-based assets under management that mandate ESG factors rose by about $5 trillion within the past two years.