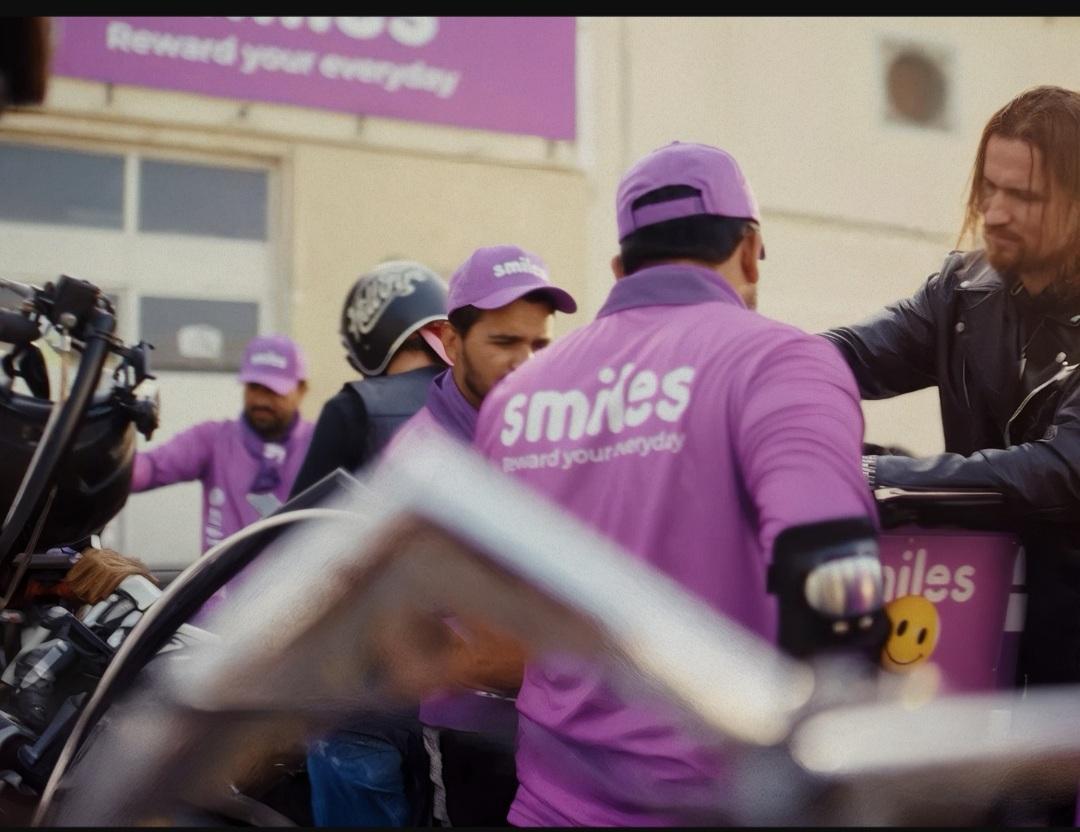

- 330% customer growth rate during the year and we provide our services to 1000 companies for a growth rate of 145%

Interview conducted by: Khaled Hassan

Written by: Mohamed El-Khouly

Ahmed Nasef, CEO of Operations and General Manager of Dopay, specialized in the field of digital payments for salaries, confirmed that the company contributed to providing customers' salaries by about one billion pounds through the companies contracted with it during 12 months from September 2023 to September 2024, explaining that the company achieved a growth in its business volume of about 323% during the period and targeting the same percentage during the next year.

During the press conference held recently by the company, he explained that the company is studying adding a rewards feature to the "Dubai" card through points or "cash back" during the coming year, saying that in the first quarter of 2025, the card will be available to be linked to the "InstaPay" application.

He pointed out that his company aims to expand externally by the end of 2025 after studying the best opportunities in the Middle East countries.

Nassef said that the number of companies contracted with it increased by 143% in one year from September 2023 to September 2024 to record about a thousand companies currently, explaining that the number of individuals jumped by about 332% during the same period.

The CEO of "Dubai" explained that the company has contracted with more than 1,000 companies during the current period, most notably the security sectors and the agricultural sector, whether agricultural associations or banks specialized in the agricultural sector.

He added that the "Dubai" platform works to link the payment card to all ATMs without fees for the first 5 transactions per month from any ATM affiliated with all banking banks to facilitate the customer regardless of his location.

Nasef explained that receiving the card is free of charge and there are no fees on it during its use and it reaches the customer at his place of residence in the governorates of the Republic, adding that the security feature on the card is subject to the supervision of the partner bank as well as "Dubai" after selecting the company targeted to contract with and reviewing all its papers and verifying the validity of all data and commercial register and others.

He continued that "Dubai" targets all private sector companies regardless of the number of their employees without linking to a minimum or maximum, explaining that the salary arrives on the payment card even on official holidays or vacations to facilitate all parties.

The CEO of "Dubai" added that immediately upon contracting with the company, the "Dubai" payment card arrives within two weeks, indicating that his company provides services to all workers, whether seasonal, part-time or full-time.

The company confirmed that it provides a payment card to customers to receive their salaries by contracting with their companies for free without any fees, explaining that the fees on the card are in the event of its loss and the extraction of a replacement.

He referred to the "Cash Early" service provided by the "Dubai" platform in order to ensure that customers pay their obligations early before falling into the trap of late interest.

Ahmed Nasef explained that the customer can obtain part of his salary during the month before the monthly collection date after coordination with the contracted companies.

The company's CEO continued that considering the bank account as an essential thing in building the future, "Dubai" was keen to provide digital services to customers to support financial inclusion.

He considered that there are two ways to achieve this goal, the first of which is to go to the customer to convince him to open a bank account to obtain the "Dubai" card for salaries and payments.

"Dubai" indicated that it is keen to avoid any difficulties in convincing customers to open an account, especially the category that is accustomed to paying its obligations in cash.

Nasef added that "Dubai" targets companies that wish to pay employees' salaries in a safer way through payment cards provided by "Dubai" to ease the financial burdens on companies.