By : Basel Khaled

AdMazad, the developer of Egypt’s only out-of-home (OOH) advertising performance measurement and analytics tool - AdMetrics, released its annual market report, announcing that the total outdoor advertising rental in 2022 was valued at EGP 3.1bn, up 6.5% y-o-y. In preparation of this report AdMazad completed over 35,000 billboard audits across Greater Cairo and Alexandria throughout 2022.

Despite a year that presented itself with its own set of economic challenges, the outdoor advertising market fared relatively well.

Growth in spend on billboard rentals was highest in the Fintech sector, up 70% y-o-y, followed by the Confectionery & Snacks segment at 65% y-o-y. Real estate, which accounts for the lionshare of total market value, also saw positive growth throughout its various sectors; including second homes (62% y-o-y) and residential properties (14% y-o-y), followed by the fast food sector increased by 61% y-o-y, the e-commerce sector at 46% y-o-y, and the telecommunications sector at 44% y-o-y.

Meanwhile, the Consumer Electronics and Automotives were among those that saw a decline in OOH expenditure during 2022, down 26% y-o-y and 63% y-o-y, respectively, in addition to the charity sector 45% y-o-y, the consumer electronics sector 26% y-o-y, and education by 6%.

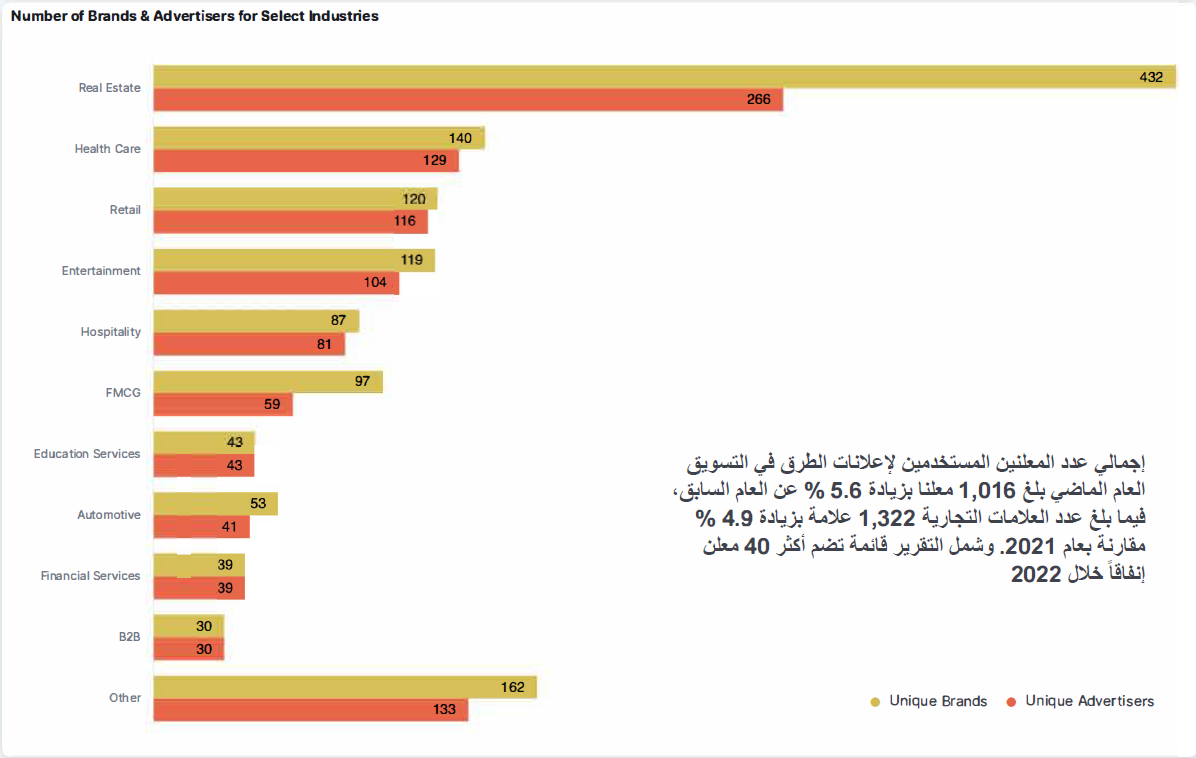

It is also worth noting that a total of 1,016 advertisers, and 1,322 unique brands, utilized outdoor advertising in their marketing mix last year, up 5.6% and 4.9%, respectively, compared to 2021.

Where did the brands advertise?

Cairo 2022 AdSpace Heat Map

Other key metrics released in the report included:

● Outdoor billboards’ utilization rate dipped 5.6% y-o-y.

● Billboard impressions jumped 27.8% y-o-y to 142.3bn.

● The average cost of every 1,000 impressions (CPM) was down 6.3% y-o-y, at EGP 22.0.

● October Bridge had the highest average CPM, at EGP 49.3.

● West Cairo had the highest average Dwell Time, at 29.0 seconds during peak traffic hours.

“Looking ahead, the OOH market is expected to pace its rate of growth given the current economic environment,” said Assem Memon, Founding Partner and Managing Director at AdMazad. “With that in mind, we remain cautiously optimistic about the overall outlook. Services sectors should continue to see an increase in out-of-home advertising investments this year.

Import-heavy sectors, however, are unlikely to start recovering before next July. In terms of industry trends, we are on the lookout for more digital screens spreading throughout Greater Cairo.”

“The AdMetrics’ data empowers advertisers to make informed decisions - a benefit I can only describe as a “must-have” at a time like this,” said Amr El Messidi, Commercial Director.

“Our tools enable brand managers to plan and validate outdoor campaigns before deployment. As well allowing them to actively track them post-launch, and benchmark campaign performance against industry standards and historic campaigns.”